Payroll taxes with local state and federal governments. Want to calculate your employees payroll taxes.

What Is Eftps An Employer S Guide To The Electronic Federal Tax Payment System

A quarter consist of three calendar months starting on the first day of the first month and ending on the last day of the last month of that quarter.

. Employees should be given Form 1099-R. For federal taxes including unemployment taxes follow the IRS instructions. You can use EFTPS to pay the federal excise taxes online or over the phone.

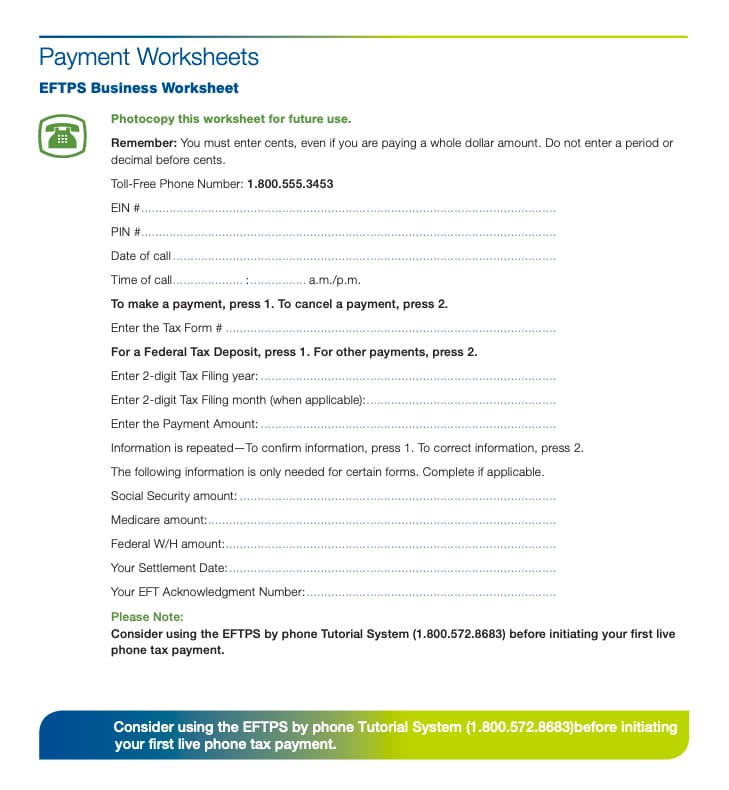

Employees can be paid in a variety of methods cash check direct deposit and federal taxes should be paid through the Electronic Federal Tax Payment System EFTPS. File Form 1099-NEC Nonemployee Compensation with the IRS for reporting nonemployee compensation paid in 2021. 2 Call the EFTPS Tax Payment toll-free number available 24 hours a day 7 days a week.

This form contains blank vouchers for mailing your estimated tax payments. Pay the employers portion of Social Security or Medicare tax. Department of Treasury to pay your federal taxes.

The notice you received is a standard letter received by all new businesses. This includes withholding on sick pay. EFTPS offered for free by the US.

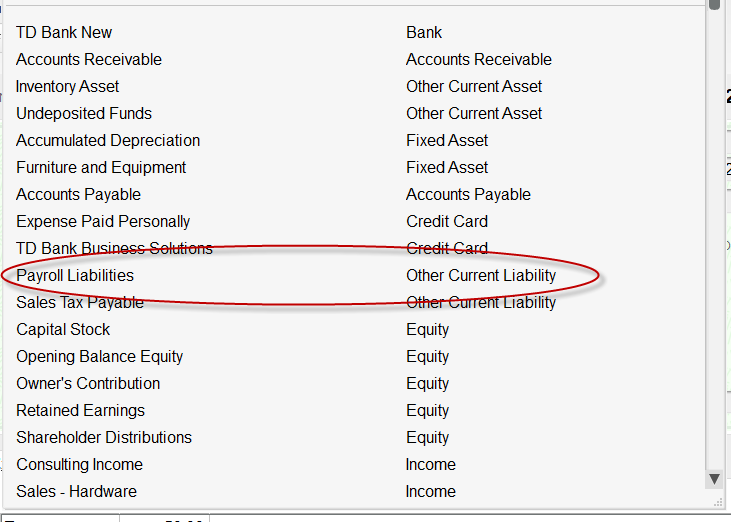

They also show up on PL reports as expenses. Personal income taxes due after you file Form 1040 can also be paid using the EFTPS. Employers use Form 941 to.

How you can Deposit Employment Taxes Theres two means of depositing employment taxes. Last day to mail or electronically file Copy A of Forms W-2 and W-3 with the SSA. Excise taxes which youll withhold when customers buy certain goods or services such as gasoline or tanning services.

The federal government has excise taxes for certain goods such as gasoline and alcohol. Once enrolled in EFTPS your business can use EFTPS to make tax payments electronically for the following taxes. Enter Tax Payment Type.

Tax FormTax Description Based on the selection in step 5 EFTPS prompts. Aggregate Filers and Professional Employer Organizations Aggregate Filers appointed by an employer on IRS Form 2678 EmployerPayer Appointment of Agent assume liability along with the employer for the employers Social. A reporting agent may also deposit and pay taxes on the clients behalf.

This means payroll taxes are counted twice on PL reports You do your Bookkeeping of the Payment by using Pay Liabilities and this is a Paperless Check and you put EFTPS because you need to indicate you Paid Online. As an employer youre generally required to deposit the employment taxes reported on Forms 941 Employers QUARTERLY Federal Tax Return or Form 944 Employers ANNUAL Federal Tax Return. EFTPS is a free system offered by the US.

Both forms report federal income tax withheld from your employees along with the employers and employees shares of social security and Medicare tax. Electronic Federal Tax Payment System EFTPS that is a free service. It is a tax-payment federal system that assists businesses in paying taxes online.

They can use the system to pay a variety of fees. Report income taxes withheld from employees paychecks. Form 720 Quarterly Federal Excise Tax Return Form 940 Employers Annual Federal Unemployment Tax FUTA Return Form 941 Employers Quarterly Federal Tax Return Form 943 Employers Annual Tax Return for Agriculture Employees.

The easiest way to pay all your federal taxes. Also if you expect to owe more than 1000 in federal income taxes at the years end quarterly estimated payments may be required. Federal Income Tax and Social Security and Medicare Tax.

They pay employment taxes and make federal tax deposits through the IRSs Electronic Federal Tax Payment System EFTPS. If the IRS advises the employer to file Form 941 quarterly return they must do so. Today more than 12 million businesses and individuals use EFTPS.

And to deposit the taxes you should use the Electronic Federal Tax Payment System EFTPS. You must also report taxes you deposit by filing Forms 941 943 944 945 and 940 on paper or through e-file. 3-to 6-digit tax form number from IRS Tax Form NumbersCodes on pages 10-12 EFTPS responds.

Enter the 3-to 6- digit Tax Form number You enter. If youre filing as a self-employed individual or disregarded entity ie. This EFTPS tax payment service Web site supports Microsoft Internet Explorer for Windows Google Chrome for Windows and Mozilla Firefox for Windows.

Press 1 To initiate a tax payment EFTPS prompts. 18005553453 3 Follow the voice prompts to select the tax form payment type period and amount and subcategory information if applicable. And to deposit the taxes you should use the Electronic Federal Tax Payment System EFTPS.

1 Gather your information including your EIN for business or SSN for individual PIN and tax form number. A Form 8655 PDF PDF reporting agent provides payroll services for one or more employers using each clients employers employer identification number EIN to file separate returns generally e-file only on the clients behalf. If you are required to make deposits electronically but do not wish to use the EFTPS.

Employers can enroll online at EFTPSgov or by calling 800-555-4477 for an enrollment form. Never use Write Check or Bills for payroll in QB. The signature section of that form says I understand that this agreement does not relieve me as the taxpayer of the responsibility to ensure that all tax returns are filed and that all deposits and payments are made and that I may enroll in the Electronic Federal Tax Payment System EFTPS to view deposits and payments made on my behalf.

It includes federal employment taxes income taxes and corporate taxes. You use Form 941 to report wages paid and the taxes due on those wages quarterly. Form 941 is due at the end of the following month.

When making your electronic federal tax payment using three pieces of identification safeguards your privacy and secures your information. 1 mail or generate a check money order or money with Form 8109 that is a Federal Tax Deposit Coupon to some lender thats an approved depository for federal taxes usually your bank. You should send a Form 941 to the address listed on the form or e-file online.

Single-member LLC partnership or S Corp shareholder you should complete Form 1040-ES. The EFTPS Electronic Federal Tax Payment System is the IRSs online system for paying estimated taxes. You can also make your payments using the Electronic Federal Tax Payment System EFTPS.

EFTPS stands for Electronic Federal Tax Payment System. If a taxpayers not sure which form they should file they can call the IRS at 800-829-4933 or 267-941-1000. Department of Treasury allows employers to make and verify federal tax payments electronically 24 hours a day seven days a week online or by phone.

If you either paid reportable gambling winnings or with-held income tax from gambling winnings you paid in. If your business sells these types of goods you may need to collect excise tax from customers at the point of sale. You may use this Web site and our voice response system 18005553453 interchangeably to make payments.

Security you can count on. We can help with that LLC or corporate taxes due after filing Form 1065 Form 1120S or 1120. In general employers who withhold federal income tax social security or Medicare taxes must file Form 941 Employers Quarterly Federal Tax Return each quarter.

What Is Eftps An Employer S Guide To The Electronic Federal Tax Payment System

How To Make 941 Federal Tax Deposit Using Eftps Site Youtube

0 Comments